Nobody likes Wall Street. So it’s not really helpful when JP Morgan Chase CEO Jamie Dimon or former Treasury Secretary Paul O’Neill, or even current Treasury Secretary Timothy Geithner issue dire warnings about what will happen if Congress fails to lift the U.S. debt ceiling before August 2nd. We hear them say: “the banking system will collapse” and it sounds like 2007 all over again.

Nobody likes Wall Street. So it’s not really helpful when JP Morgan Chase CEO Jamie Dimon or former Treasury Secretary Paul O’Neill, or even current Treasury Secretary Timothy Geithner issue dire warnings about what will happen if Congress fails to lift the U.S. debt ceiling before August 2nd. We hear them say: “the banking system will collapse” and it sounds like 2007 all over again.

Whether you’re a factory worker in Omaha, a letter carrier in Detroit, an office worker in Jersey City or a T-Party adherent in Cleveland, you would probably have the same reaction: “Why do I care if the financial marauders get thrown under the bus?”

As much as we dislike the messengers, however, the message they are sending just happens to be true. And bet your last dollar that the biggest losers will, again, be America’s working people.

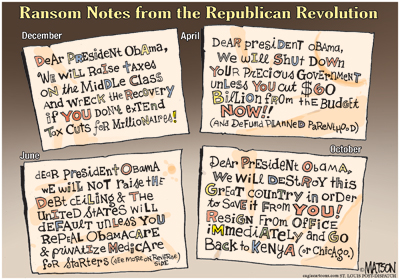

Republican congressional leaders are publicly stating that it might be a good thing to let the deadline pass, but privately many of them—tea partiers and the so-called “moderate” Republicans alike—are hearing plenty from corporate America.

Once again, working Americans and corporate America are on the same side, albeit for different reasons. If it all goes under, we all go under.

The Republican party line is that they want to “force government to live within its means.” House Speaker John Boehner says his side won’t relent until Democrats agree to $3 trillion in spending cuts without any increase in taxes.

Chamber of Commerce EVP R. Bruce Josen called the congressional kerfuffle over the U.S. debt limit a “joke” while leading economist Lou Campbell called it “theater.” But, no one is entertained, and nobody is laughing about the economic consequences that would follow if Congress fails to increase the debt limit.

Here’s what would happen:

The U.S. will default on obligations it has already incurred. (It would be illegal to write checks with no available funds to honor them.)

Social Security payments will stop. As would Veterans benefits. Troops would go unpaid. There will be no money to pay federal workers salaries or benefits.

No mail service. Government agencies will shut down. Corporate and individual creditors (bond holders) will go unpaid.

If that isn’t bad enough—foreign creditors would be cut off, including China, our biggest lender. All the

nations that sell us oil will go unpaid. Oil shipments will stop.

Getting the picture?

Not like this hasn’t happened before. California—the eighth largest economy in the world—briefly flirted with default in 2009 when the legislature and the

governor couldn’t agree on a budget. The result: the state issued IOUs to vendors and creditors, but held enough cash back to pay its general obligation

bonds. Even today, California remains in a precarious financial position as financial experts note that the state owes some $15 billion to bond holders

even though revenues have fallen by some 15%. California must take steps before the end of June to either renew a series of taxes enacted during the height of the recession, or risk defaulting on its debt.